Golden Rules of Accounting: Meaning, Types & Examples

Golden rules of accounting help businesses record transactions correctly by deciding which account to debit and credit, ensuring accurate financial records.

Accounting is the backbone of every business, as it helps in recording, classifying, and tracking all financial transactions accurately. Whenever a business transaction occurs, it is essential to decide which account should be debited and which account should be credited.

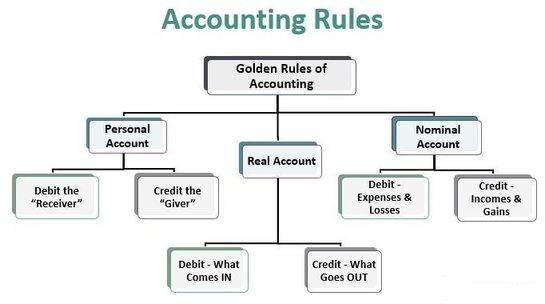

One of the most important foundations of traditional accounting is the three Golden Rules of Accounting. These three rules provide a systematic approach to deciding which account should be debited and which should be credited for every transaction and also help ensure consistency, accuracy, and clarity while passing journal entries.

What Are the Golden Rules of Accounting?

The golden rules of accounting are fundamental principles used to determine the debit and credit aspects of a transaction. These rules are based on the traditional classification of accounts.

By identifying the type of account involved in a transaction, the correct accounting treatment can be applied without confusion.

Types of Accounts in Accounting

Under the traditional approach, accounts are classified into three main types:

- Nominal Account

- Personal Account

- Real Account

Each type follows a specific debit and credit rule, explained below with simple examples.

Nominal Account

Nominal accounts relate to expenses, losses, incomes, and gains of the business. Examples of Nominal Accounts: Salary Expense, Rent Expense, Electricity Bill, Commission Income, Interest Received

Rule of Nominal Account - Debit All Expenses and Losses, Credit All Incomes and Gains.

This means:

- All the expenses & losses are debited

- All the incomes and gains is credited

Examples:

| Transaction | Debit | Credit |

| Paid office rent | Rent A/c | Cash A/c |

| Paid electricity bill | Electricity Expense A/c | Cash A/c |

| Received commission income | Cash A/c | Commission Income A/c |

Personal Account

Personal accounts relate to persons, firms, companies, and institutions. In simple terms, any account that represents a person or an entity capable of receiving or giving value is classified as a personal account. Bank accounts are also treated as personal accounts.

Rule of Personal Account - Debit the Receiver, Credit the Giver

This means:

- The person or entity receiving the benefit is debited

- The person or entity giving the benefit is credited

Examples of Personal Account Transactions

| Transaction | Debit | Credit |

| Paid cash to supplier | Supplier A/c | Cash A/c |

| Received cash from customer | Cash A/c | Customer A/c |

| Salary paid to employee | Employee A/c | Cash A/c |

| Rent paid in advance | Prepaid Rent A/c | Cash A/c |

Personal accounts are further classified into three sub-categories:

a) Natural Personal Account

Natural personal accounts relate to individual human beings. These accounts are maintained in the name of real persons who are directly involved in business transactions. Examples: Capital Account, Drawings Account, Debtors (Customers), Creditors (Suppliers)

Example Transaction:

- If cash is paid to a supplier, the supplier receives the benefit and hence the supplier’s account is debited, while cash is credited.

b) Artificial Personal Account

Artificial personal accounts represent organizations or institutions that are not human beings but are treated as separate legal entities according to law. These entities can enter into contracts and carry out financial transactions in their own name. Examples: Bank Account, Government Authorities, Companies, Hospitals.

Example Transaction:

- If money is deposited into a bank account, the bank (an artificial person) receives the amount, so the bank account is debited and cash is credited.

C) Representative Personal Account

Representative personal accounts represent a person or group of persons indirectly. These accounts usually arise when an amount is outstanding, prepaid relating to either the previous or the coming accounting period. Examples: Outstanding Salary Account, Prepaid Rent Account, Outstanding Expenses, Accrued Income

Example Transactions:

- Salary due to employees for the previous year is recorded as Outstanding Salary, representing employees indirectly.

- Rent paid in advance for the coming year is recorded as Prepaid Rent, representing the landlord.

Real Account

Like personal accounts, a real account is also a type of general ledger. However, real accounts record transactions related to a business’s assets and properties. Real accounts relate to assets and properties owned by the business. They mainly deal with what the business owns, rather than people or expenses.

Rule of Real Account - Debit what comes in, Credit what goes out

This rule means:

- When an asset comes into the business, it is debited

- When an asset goes out of the business, it is credited

Types of Assets in Real Accounts

a) Tangible Assets

Tangible assets are assets that have a physical existence and can be seen or touched. Examples: Land, Buildings, Machinery, Furniture, Vehicles and Inventory

b) Intangible Assets

Intangible assets do not have a physical form but still provide long-term value to the business. Examples: Goodwill, Patents, Copyrights, Trademarks and Software Licenses

Examples of Real Account Transactions

| Transaction | Debit | Credit |

| Purchased machinery by cash | Machinery A/c | Cash A/c |

| Bought furniture on credit | Furniture A/c | Supplier A/c |

| Sold old equipment for cash | Cash A/c | Equipment A/c |

Why Golden rules are important?

The golden rules are important because they:

- Help in passing correct journal entries

- Reduce accounting errors

- Ensure proper ledger posting

- Improve accuracy of financial statements

- Make accounting easy for beginners and professionals

Conclusion

The golden rules of accounting form the backbone of traditional accounting. By understanding the three types of accounts and their respective rules, businesses can record transactions confidently and accurately. These rules simplify accounting processes and ensure reliable financial records for decision-making.

Using modern ERP Software like ERPNext with right configurations and proper workflows, you can automate the process of accounting to help you record all your financial transactions and get updated financial reports.

Shalini Dondeti

ERP Software Developer

No comments yet. Login to start a new discussion Start a new discussion